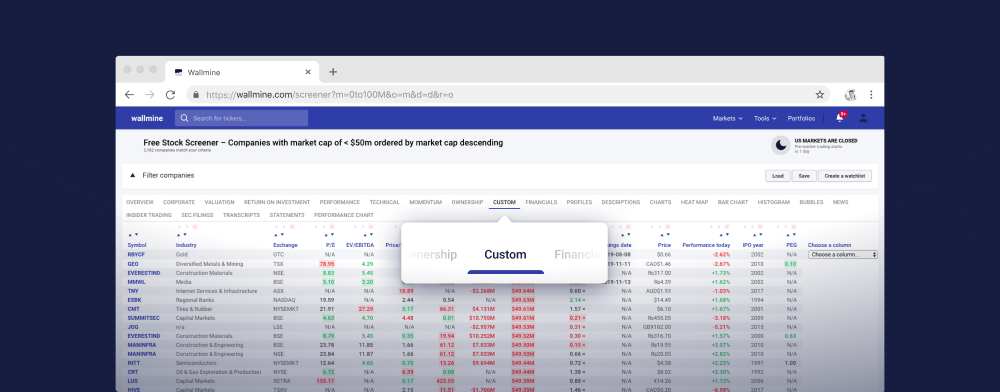

Stock screener gratuit

Load Sauvegarder Créer une liste de surveillance Help| Capitalisation boursière | $673.66B |

|---|---|

| Valeur d'entreprise | $786.58B |

| Revenu | $224.912B |

|---|---|

| BAIIA | $26.516B |

| Revenu | -$50.55 |

| Revenu Q/Q | 9.00% |

| Revenu Y/Y | N/A |

| P/E | 41.44 |

|---|---|

| Transmettre P/E | 21.88 |

| EV/Sales | 3.50 |

| VE/BAIIA | 29.66 |

| EV/EBIT | N/A |

| PEG | 9.68 |

| Prix / Ventes | 3.00 |

| P/FCF | 32.19 |

| Prix/Valeur | 1.82 |

| Valeur / Action | 373,008.18 |

| Cash / Action | 108,114.37 |

| FCF yield | 3.11% |

| Volume | 2.166k / 1.854k |

|---|---|

| Vol. relatif | 1.17 × |

| BPA | 16,408.39 |

|---|---|

| BPA Q/Q | 39.00% |

| BPA estimée Q/Q | 6.46% |

| Marge bénéficiaire | 32.52% |

|---|---|

| Marge oper. | -28.01% |

| Marge brute | 41.60% |

| EBIT margin | -3.72% |

| EBITDA margin | 11.79% |

| Ret. sur les actifs | 1.08% |

|---|---|

| Ret. sur l'équité | 2.69% |

| ROIC | 10.29% |

| ROCE | -1.08% |

| Dette/Equité | 0.88 |

|---|---|

| Net debt/EBITDA | -1.09 |

| Current ratio | 1.46 |

| Quick ratio | 1.26 |

| Volatilité | 1.58% |

|---|---|

| Beta | 0.90 |

| RSI | 67.94 |

|---|

| Gamme | $668,265.00 – $687,143.30 |

|---|---|

| 52 semaines | $504,050.06 – $741,971.00 |

| SMA 50 | $654,004 +3.83% |

| SMA 200 | $625,344 +8.04% |

| Propriété du management | 42.91% |

|---|---|

| Proprieté inst. | 20.27% |

| Actions en circ. | 619.938k |

|---|---|

| Float d'actions | 1.207M 194.67% |

| Court % de float | 0.20% |

| Ratio court | 0.25 |

| Dividende | N/A |

|---|---|

| Rendement en dividendes | N/A |

| Le ratio de distribution | N/A |

| Date de paiement | N/A |

| Date ex-dividende | N/A |

| Date de gains | N/A |

| Année d'introduction en bourse | 1980 |

|---|---|

| Pays | United States |

MRF

| Capitalisation boursière | $4.86B |

|---|---|

| Valeur d'entreprise | $5.05B |

| Revenu | ₨259.298B |

|---|---|

| BAIIA | ₨20.937B |

| Revenu | ₨20.635B |

| Revenu Q/Q | 11.74% |

| Revenu Y/Y | 9.13% |

| P/E | 18.79 |

|---|---|

| Transmettre P/E | 13.70 |

| EV/Sales | 1.56 |

| VE/BAIIA | 19.26 |

| EV/EBIT | N/A |

| PEG | 0.87 |

| Prix / Ventes | 1.50 |

| P/FCF | 0.15 |

| Prix/Valeur | 2.32 |

| Valeur / Action | 58,576.29 |

| Cash / Action | 1,699.41 |

| FCF yield | N/A |

| Volume | 153.000 / 476.000 |

|---|---|

| Vol. relatif | 0.32 × |

| BPA | 7,236.45 |

|---|---|

| BPA Q/Q | N/A |

| BPA estimée Q/Q | -3.77% |

| Marge bénéficiaire | 8.27% |

|---|---|

| Marge oper. | 11.02% |

| Marge brute | 38.89% |

| EBIT margin | N/A |

| EBITDA margin | 8.07% |

| Ret. sur les actifs | 4.59% |

|---|---|

| Ret. sur l'équité | 12.34% |

| ROIC | 6.48% |

| ROCE | 0.00% |

| Dette/Equité | 0.61 |

|---|---|

| Net debt/EBITDA | N/A |

| Current ratio | 1.37 |

| Quick ratio | 0.79 |

| Volatilité | 1.98% |

|---|---|

| Beta | 0.37 |

| RSI | 50.50 |

|---|

| Gamme | ₨135,425.40 – ₨136,399.95 |

|---|---|

| 52 semaines | ₨106,390.70 – ₨151,283.41 |

| SMA 50 | ₨136,477 -0.54% |

| SMA 200 | ₨133,551 +1.62% |

| Propriété du management | 36.60% |

|---|---|

| Proprieté inst. | 17.66% |

| Actions en circ. | 4.241M |

|---|---|

| Float d'actions | 2.471M 58.27% |

| Court % de float | N/A |

| Ratio court | N/A |

| Dividende | ₨200.00 |

|---|---|

| Rendement en dividendes | 0.15% |

| Le ratio de distribution | 2.76% |

| Date de paiement | N/A |

| Date ex-dividende | N/A |

| Date de gains | N/A |

| Année d'introduction en bourse | 2000 |

|---|---|

| Pays | India |

MRF

| Capitalisation boursière | $4.86B |

|---|---|

| Valeur d'entreprise | $4.83B |

| Revenu | ₨259.298B |

|---|---|

| BAIIA | ₨20.891B |

| Revenu | ₨20.635B |

| Revenu Q/Q | 11.74% |

| Revenu Y/Y | 9.13% |

| P/E | 18.81 |

|---|---|

| Transmettre P/E | N/A |

| EV/Sales | 1.49 |

| VE/BAIIA | 18.44 |

| EV/EBIT | N/A |

| PEG | N/A |

| Prix / Ventes | 1.50 |

| P/FCF | 0.15 |

| Prix/Valeur | 2.32 |

| Valeur / Action | 58,532.46 |

| Cash / Action | 1,698.14 |

| FCF yield | N/A |

| Volume | 3.411k / 9.837k |

|---|---|

| Vol. relatif | 0.35 × |

| BPA | 7,231.04 |

|---|---|

| BPA Q/Q | N/A |

| BPA estimée Q/Q | 258.93% |

| Marge bénéficiaire | 8.27% |

|---|---|

| Marge oper. | 11.02% |

| Marge brute | 38.89% |

| EBIT margin | N/A |

| EBITDA margin | 8.06% |

| Ret. sur les actifs | 2.60% |

|---|---|

| Ret. sur l'équité | 4.88% |

| ROIC | N/A |

| ROCE | 0.00% |

| Dette/Equité | 0.61 |

|---|---|

| Net debt/EBITDA | N/A |

| Current ratio | 1.37 |

| Quick ratio | 0.79 |

| Volatilité | 2.08% |

|---|---|

| Beta | 0.30 |

| RSI | 49.93 |

|---|

| Gamme | ₨135,500.00 – ₨136,476.10 |

|---|---|

| 52 semaines | ₨106,405.00 – ₨151,445.00 |

| SMA 50 | ₨136,665 -0.79% |

| SMA 200 | ₨133,705 +1.40% |

| Propriété du management | 48.33% |

|---|---|

| Proprieté inst. | 14.25% |

| Actions en circ. | 4.241M |

|---|---|

| Float d'actions | 2.500M 58.94% |

| Court % de float | N/A |

| Ratio court | N/A |

| Dividende | ₨200.00 |

|---|---|

| Rendement en dividendes | 0.15% |

| Le ratio de distribution | 2.77% |

| Date de paiement | N/A |

| Date ex-dividende | N/A |

| Date de gains | N/A |

| Année d'introduction en bourse | 2002 |

|---|---|

| Pays | India |

| Capitalisation boursière | $23.50B |

|---|---|

| Valeur d'entreprise | N/A |

| Revenu | CHF4.800B |

|---|---|

| BAIIA | CHF876.900M |

| Revenu | CHF527.300M |

| Revenu Q/Q | 10.38% |

| Revenu Y/Y | 11.54% |

| P/E | 82.91 |

|---|---|

| Transmettre P/E | N/A |

| EV/Sales | N/A |

| VE/BAIIA | N/A |

| EV/EBIT | N/A |

| PEG | N/A |

| Prix / Ventes | 4.92 |

| P/FCF | 39.34 |

| Prix/Valeur | 4.26 |

| Valeur / Action | 25,736.24 |

| Cash / Action | 5,850.71 |

| FCF yield | 2.53% |

| Volume | 0.000 / 2.000 |

|---|---|

| Vol. relatif | 0.00 × |

| BPA | 1,321.90 |

|---|---|

| BPA Q/Q | N/A |

| BPA estimée Q/Q | N/A |

| Marge bénéficiaire | 10.64% |

|---|---|

| Marge oper. | 14.49% |

| Marge brute | 67.08% |

| EBIT margin | 14.49% |

| EBITDA margin | 18.27% |

| Ret. sur les actifs | 5.51% |

|---|---|

| Ret. sur l'équité | 11.62% |

| ROIC | 6.02% |

| ROCE | 10.80% |

| Dette/Equité | 0.71 |

|---|---|

| Net debt/EBITDA | 0.03 |

| Current ratio | 1.87 |

| Quick ratio | 1.07 |

| Volatilité | 1.14% |

|---|---|

| Beta | 0.33 |

| RSI | 55.44 |

|---|

| Gamme | CHF106,400.00 – CHF108,400.00 |

|---|---|

| 52 semaines | CHF95,000.00 – CHF113,400.00 |

| SMA 50 | CHF108,589 -2.06% |

| SMA 200 | CHF107,191 -0.74% |

| Propriété du management | 24.44% |

|---|---|

| Proprieté inst. | 24.59% |

| Actions en circ. | 241.230k |

|---|---|

| Float d'actions | 200.790k 83.24% |

| Court % de float | N/A |

| Ratio court | N/A |

| Dividende | N/A |

|---|---|

| Rendement en dividendes | N/A |

| Le ratio de distribution | N/A |

| Date de paiement | N/A |

| Date ex-dividende | N/A |

| Date de gains | N/A |

| Année d'introduction en bourse | 2020 |

|---|---|

| Pays | Switzerland |

| Capitalisation boursière | $4.60B |

|---|---|

| Valeur d'entreprise | $4.26B |

| Revenu | ₨31.084B |

|---|---|

| BAIIA | ₨4.194B |

| Revenu | ₨3.822B |

| Revenu Q/Q | 7.74% |

| Revenu Y/Y | 4.76% |

| P/E | 135.86 |

|---|---|

| Transmettre P/E | 80.58 |

| EV/Sales | 10.94 |

| VE/BAIIA | 81.09 |

| EV/EBIT | 83.51 |

| PEG | N/A |

| Prix / Ventes | 11.80 |

| P/FCF | N/A |

| Prix/Valeur | 15.53 |

| Valeur / Action | 3,296.00 |

| Cash / Action | 2,330.37 |

| FCF yield | N/A |

| Volume | 2.080k / 7.741k |

|---|---|

| Vol. relatif | 0.27 × |

| BPA | 376.67 |

|---|---|

| BPA Q/Q | N/A |

| BPA estimée Q/Q | N/A |

| Marge bénéficiaire | 11.50% |

|---|---|

| Marge oper. | 13.10% |

| Marge brute | 47.15% |

| EBIT margin | 13.10% |

| EBITDA margin | 13.49% |

| Ret. sur les actifs | 6.20% |

|---|---|

| Ret. sur l'équité | 13.50% |

| ROIC | 7.10% |

| ROCE | 13.46% |

| Dette/Equité | 0.41 |

|---|---|

| Net debt/EBITDA | N/A |

| Current ratio | 3.38 |

| Quick ratio | 3.26 |

| Volatilité | 2.59% |

|---|---|

| Beta | 0.31 |

| RSI | 42.56 |

|---|

| Gamme | ₨50,652.35 – ₨51,498.00 |

|---|---|

| 52 semaines | ₨34,977.70 – ₨59,994.00 |

| SMA 50 | ₨52,493 -2.14% |

| SMA 200 | ₨48,284 +6.05% |

| Propriété du management | 78.98% |

|---|---|

| Proprieté inst. | 9.61% |

| Actions en circ. | 8.842M |

|---|---|

| Float d'actions | 2.196M 24.84% |

| Court % de float | N/A |

| Ratio court | N/A |

| Dividende | ₨100.00 |

|---|---|

| Rendement en dividendes | 0.20% |

| Le ratio de distribution | 26.55% |

| Date de paiement | N/A |

| Date ex-dividende | N/A |

| Date de gains | N/A |

| Année d'introduction en bourse | 2002 |

|---|---|

| Pays | India |

| Capitalisation boursière | $4.51B |

|---|---|

| Valeur d'entreprise | $4.28B |

| Revenu | ₨31.692B |

|---|---|

| BAIIA | ₨5.730B |

| Revenu | ₨4.742B |

| Revenu Q/Q | -14.10% |

| Revenu Y/Y | 88.28% |

| P/E | 90.42 |

|---|---|

| Transmettre P/E | N/A |

| EV/Sales | 10.78 |

| VE/BAIIA | 59.61 |

| EV/EBIT | 45.50 |

| PEG | N/A |

| Prix / Ventes | 11.89 |

| P/FCF | N/A |

| Prix/Valeur | 20.84 |

| Valeur / Action | 2,454.08 |

| Cash / Action | 1,705.19 |

| FCF yield | N/A |

| Volume | 124.000 / 206.000 |

|---|---|

| Vol. relatif | 0.60 × |

| BPA | 565.70 |

|---|---|

| BPA Q/Q | N/A |

| BPA estimée Q/Q | N/A |

| Marge bénéficiaire | 14.94% |

|---|---|

| Marge oper. | 17.42% |

| Marge brute | 49.69% |

| EBIT margin | 17.42% |

| EBITDA margin | 18.08% |

| Ret. sur les actifs | 11.74% |

|---|---|

| Ret. sur l'équité | 23.10% |

| ROIC | 13.44% |

| ROCE | N/A |

| Dette/Equité | 0.59 |

|---|---|

| Net debt/EBITDA | N/A |

| Current ratio | 2.53 |

| Quick ratio | 2.43 |

| Volatilité | 2.97% |

|---|---|

| Beta | 0.31 |

| RSI | 38.81 |

|---|

| Gamme | ₨50,850.00 – ₨51,448.00 |

|---|---|

| 52 semaines | ₨34,990.00 – ₨59,700.00 |

| SMA 50 | ₨52,983 -3.76% |

| SMA 200 | ₨48,060 +5.88% |

| Propriété du management | 75.17% |

|---|---|

| Proprieté inst. | 13.87% |

| Actions en circ. | 8.842M |

|---|---|

| Float d'actions | 2.161M 24.44% |

| Court % de float | N/A |

| Ratio court | N/A |

| Dividende | ₨100.00 |

|---|---|

| Rendement en dividendes | 0.19% |

| Le ratio de distribution | 17.68% |

| Date de paiement | N/A |

| Date ex-dividende | N/A |

| Date de gains | N/A |

| Année d'introduction en bourse | 2000 |

|---|---|

| Pays | India |

PAGEIND

| Capitalisation boursière | $6.49B |

|---|---|

| Valeur d'entreprise | $6.62B |

| Revenu | ₨23.953B |

|---|---|

| BAIIA | ₨2.878B |

| Revenu | ₨1.930B |

| Revenu Q/Q | -65.89% |

| Revenu Y/Y | 9.47% |

| P/E | 234.67 |

|---|---|

| Transmettre P/E | 89.29 |

| EV/Sales | 22.06 |

| VE/BAIIA | 183.61 |

| EV/EBIT | 95.09 |

| PEG | 5.59 |

| Prix / Ventes | 11.14 |

| P/FCF | N/A |

| Prix/Valeur | 56.58 |

| Valeur / Action | 740.95 |

| Cash / Action | 107.71 |

| FCF yield | N/A |

| Volume | 750.000 / 422.000 |

|---|---|

| Vol. relatif | 1.78 × |

| BPA | 178.65 |

|---|---|

| BPA Q/Q | N/A |

| BPA estimée Q/Q | 19.46% |

| Marge bénéficiaire | 11.65% |

|---|---|

| Marge oper. | 10.65% |

| Marge brute | 54.49% |

| EBIT margin | 10.65% |

| EBITDA margin | 12.02% |

| Ret. sur les actifs | 20.89% |

|---|---|

| Ret. sur l'équité | 23.07% |

| ROIC | 24.83% |

| ROCE | N/A |

| Dette/Equité | 0.85 |

|---|---|

| Net debt/EBITDA | N/A |

| Current ratio | 1.82 |

| Quick ratio | 0.48 |

| Volatilité | 2.32% |

|---|---|

| Beta | 0.73 |

| RSI | 69.82 |

|---|

| Gamme | ₨41,841.40 – ₨43,607.05 |

|---|---|

| 52 semaines | ₨33,100.00 – ₨43,607.05 |

| SMA 50 | ₨40,317 +6.76% |

| SMA 200 | ₨36,550 +15.47% |

| Propriété du management | 52.78% |

|---|---|

| Proprieté inst. | 26.51% |

| Actions en circ. | 11.154M |

|---|---|

| Float d'actions | 4.506M 40.40% |

| Court % de float | N/A |

| Ratio court | N/A |

| Dividende | ₨295.00 |

|---|---|

| Rendement en dividendes | 0.73% |

| Le ratio de distribution | 165.13% |

| Date de paiement | N/A |

| Date ex-dividende | N/A |

| Date de gains | N/A |

| Année d'introduction en bourse | 2007 |

|---|---|

| Pays | India |

PAGEIND

| Capitalisation boursière | $6.49B |

|---|---|

| Valeur d'entreprise | $6.50B |

| Revenu | ₨48.972B |

|---|---|

| BAIIA | ₨10.232B |

| Revenu | ₨7.343B |

| Revenu Q/Q | 167.43% |

| Revenu Y/Y | 54.97% |

| P/E | 65.65 |

|---|---|

| Transmettre P/E | 90.91 |

| EV/Sales | 10.59 |

| VE/BAIIA | 50.70 |

| EV/EBIT | 53.47 |

| PEG | 3.23 |

| Prix / Ventes | 10.93 |

| P/FCF | N/A |

| Prix/Valeur | 56.09 |

| Valeur / Action | 770.59 |

| Cash / Action | 198.13 |

| FCF yield | N/A |

| Volume | 56.168k / 19.486k |

|---|---|

| Vol. relatif | 2.88 × |

| BPA | 658.31 |

|---|---|

| BPA Q/Q | 1,790.22% |

| BPA estimée Q/Q | 15.12% |

| Marge bénéficiaire | 13.81% |

|---|---|

| Marge oper. | 20.10% |

| Marge brute | 55.18% |

| EBIT margin | 20.78% |

| EBITDA margin | 20.89% |

| Ret. sur les actifs | 28.07% |

|---|---|

| Ret. sur l'équité | 63.40% |

| ROIC | 28.67% |

| ROCE | N/A |

| Dette/Equité | 0.94 |

|---|---|

| Net debt/EBITDA | N/A |

| Current ratio | 1.77 |

| Quick ratio | 0.28 |

| Volatilité | 2.31% |

|---|---|

| Beta | 0.42 |

| RSI | 62.29 |

|---|

| Gamme | ₨41,781.00 – ₨43,584.05 |

|---|---|

| 52 semaines | ₨33,070.05 – ₨43,530.15 |

| SMA 50 | ₨41,307 +4.21% |

| SMA 200 | ₨37,603 +12.80% |

| Propriété du management | 46.12% |

|---|---|

| Proprieté inst. | 34.39% |

| Actions en circ. | 11.154M |

|---|---|

| Float d'actions | 6.812M 61.08% |

| Court % de float | N/A |

| Ratio court | N/A |

| Dividende | ₨595.00 |

|---|---|

| Rendement en dividendes | 1.46% |

| Le ratio de distribution | 90.38% |

| Date de paiement | N/A |

| Date ex-dividende | N/A |

| Date de gains | N/A |

| Année d'introduction en bourse | 2007 |

|---|---|

| Pays | India |

3MINDIA

| Capitalisation boursière | $3.27B |

|---|---|

| Valeur d'entreprise | $3.05B |

| Revenu | ₨25.282B |

|---|---|

| BAIIA | ₨2.436B |

| Revenu | ₨1.895B |

| Revenu Q/Q | -56.97% |

| Revenu Y/Y | 7.78% |

| P/E | 181.13 |

|---|---|

| Transmettre P/E | N/A |

| EV/Sales | 9.62 |

| VE/BAIIA | 99.87 |

| EV/EBIT | 94.76 |

| PEG | N/A |

| Prix / Ventes | 7.02 |

| P/FCF | N/A |

| Prix/Valeur | 23.00 |

| Valeur / Action | 1,518.71 |

| Cash / Action | 692.91 |

| FCF yield | N/A |

| Volume | 138.000 / 295.000 |

|---|---|

| Vol. relatif | 0.47 × |

| BPA | 192.82 |

|---|---|

| BPA Q/Q | N/A |

| BPA estimée Q/Q | N/A |

| Marge bénéficiaire | 10.79% |

|---|---|

| Marge oper. | 8.36% |

| Marge brute | 41.43% |

| EBIT margin | 8.36% |

| EBITDA margin | 9.63% |

| Ret. sur les actifs | 11.30% |

|---|---|

| Ret. sur l'équité | 11.23% |

| ROIC | 13.46% |

| ROCE | N/A |

| Dette/Equité | 0.35 |

|---|---|

| Net debt/EBITDA | N/A |

| Current ratio | 3.27 |

| Quick ratio | 2.49 |

| Volatilité | 2.89% |

|---|---|

| Beta | 0.64 |

| RSI | 38.15 |

|---|

| Gamme | ₨34,926.00 – ₨35,806.65 |

|---|---|

| 52 semaines | ₨28,424.00 – ₨41,000.00 |

| SMA 50 | ₨37,170 -5.19% |

| SMA 200 | ₨33,588 +4.94% |

| Propriété du management | 76.48% |

|---|---|

| Proprieté inst. | 5.19% |

| Actions en circ. | 11.265M |

|---|---|

| Float d'actions | 2.584M 22.94% |

| Court % de float | N/A |

| Ratio court | N/A |

| Dividende | N/A |

|---|---|

| Rendement en dividendes | N/A |

| Le ratio de distribution | N/A |

| Date de paiement | N/A |

| Date ex-dividende | N/A |

| Date de gains | N/A |

| Année d'introduction en bourse | 2000 |

|---|---|

| Pays | India |

3MINDIA

| Capitalisation boursière | $3.28B |

|---|---|

| Valeur d'entreprise | $3.10B |

| Revenu | ₨36.722B |

|---|---|

| BAIIA | ₨4.851B |

| Revenu | ₨3.682B |

| Revenu Q/Q | 16.26% |

| Revenu Y/Y | 16.48% |

| P/E | 114.32 |

|---|---|

| Transmettre P/E | N/A |

| EV/Sales | 6.74 |

| VE/BAIIA | 51.01 |

| EV/EBIT | 55.10 |

| PEG | N/A |

| Prix / Ventes | 7.14 |

| P/FCF | N/A |

| Prix/Valeur | 14.85 |

| Valeur / Action | 2,354.84 |

| Cash / Action | 1,260.82 |

| FCF yield | N/A |

| Volume | 1.922k / 5.779k |

|---|---|

| Vol. relatif | 0.33 × |

| BPA | 305.96 |

|---|---|

| BPA Q/Q | N/A |

| BPA estimée Q/Q | N/A |

| Marge bénéficiaire | 8.15% |

|---|---|

| Marge oper. | 12.23% |

| Marge brute | 36.88% |

| EBIT margin | 12.23% |

| EBITDA margin | 13.21% |

| Ret. sur les actifs | 9.17% |

|---|---|

| Ret. sur l'équité | 16.84% |

| ROIC | 9.17% |

| ROCE | 18.37% |

| Dette/Equité | 0.38 |

|---|---|

| Net debt/EBITDA | N/A |

| Current ratio | 3.19 |

| Quick ratio | 2.50 |

| Volatilité | 2.62% |

|---|---|

| Beta | 0.29 |

| RSI | 39.26 |

|---|

| Gamme | ₨34,901.10 – ₨35,500.00 |

|---|---|

| 52 semaines | ₨28,498.95 – ₨40,856.50 |

| SMA 50 | ₨37,133 -5.31% |

| SMA 200 | ₨33,666 +4.52% |

| Propriété du management | 76.48% |

|---|---|

| Proprieté inst. | 8.78% |

| Actions en circ. | 11.265M |

|---|---|

| Float d'actions | 2.611M 23.17% |

| Court % de float | N/A |

| Ratio court | N/A |

| Dividende | N/A |

|---|---|

| Rendement en dividendes | N/A |

| Le ratio de distribution | N/A |

| Date de paiement | N/A |

| Date ex-dividende | N/A |

| Date de gains | N/A |

| Année d'introduction en bourse | 2002 |

|---|---|

| Pays | India |