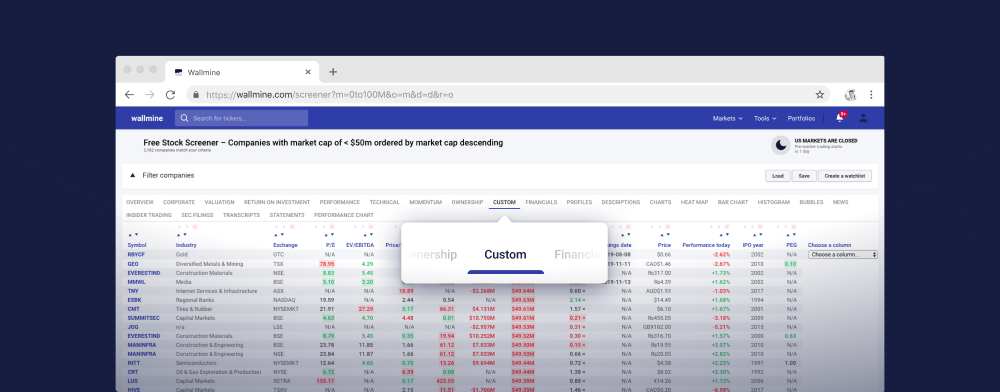

Stock screener gratuit

Load Sauvegarder Créer une liste de surveillance Help| Capitalisation boursière | $897.78M |

|---|---|

| Valeur d'entreprise | N/A |

| Revenu | $1.969B |

|---|---|

| BAIIA | N/A |

| Revenu | $217.402M |

| Revenu Q/Q | 6.43% |

| Revenu Y/Y | 9.70% |

| P/E | 3.95 |

|---|---|

| Transmettre P/E | N/A |

| EV/Sales | 0.48 |

| VE/BAIIA | N/A |

| EV/EBIT | N/A |

| PEG | N/A |

| Prix / Ventes | 0.46 |

| P/FCF | 3.00 |

| Prix/Valeur | 0.94 |

| Valeur / Action | 44.30 |

| Cash / Action | 99.84 |

| FCF yield | 33.31% |

| Volume | 25.694k / N/A |

|---|---|

| Vol. relatif | N/A |

| BPA | 10.51 |

|---|---|

| BPA Q/Q | N/A |

| BPA estimée Q/Q | N/A |

| Marge bénéficiaire | 7.92% |

|---|---|

| Marge oper. | 13.80% |

| Marge brute | 42.11% |

| EBIT margin | 13.88% |

| EBITDA margin | 12.98% |

| Ret. sur les actifs | 5.70% |

|---|---|

| Ret. sur l'équité | 22.49% |

| ROIC | 6.91% |

| ROCE | 14.74% |

| Dette/Equité | 3.11 |

|---|---|

| Net debt/EBITDA | 20.72 |

| Current ratio | 1.26 |

| Quick ratio | 1.15 |

| Volatilité | 3969061315.36% |

|---|---|

| Beta | 0.00 |

| RSI | 44.53 |

|---|

| Gamme | $40.00 – $41.49 |

|---|---|

| 52 semaines | $33.12 – $80,078,125,000,000.00 |

| SMA 50 | $38 +8.92% |

| SMA 200 | $38 +9.13% |

| Propriété du management | 35.21% |

|---|---|

| Proprieté inst. | 50.24% |

| Actions en circ. | 20.393M |

|---|---|

| Float d'actions | 0.000 0.00% |

| Court % de float | 0.09% |

| Ratio court | 3.32 |

| Dividende | $0.00 |

|---|---|

| Rendement en dividendes | 0.00% |

| Le ratio de distribution | 0.00% |

| Date de paiement | N/A |

| Date ex-dividende | N/A |

| Date de gains | N/A |

| Année d'introduction en bourse | 2012 |

|---|---|

| Pays | United States |

OILND

| Revenu | N/A |

|---|---|

| BAIIA | N/A |

| Revenu | N/A |

| Revenu Q/Q | N/A |

| Revenu Y/Y | N/A |

| P/E | N/A |

|---|---|

| Transmettre P/E | N/A |

| EV/Sales | N/A |

| VE/BAIIA | N/A |

| EV/EBIT | N/A |

| PEG | N/A |

| Prix / Ventes | N/A |

| P/FCF | N/A |

| Prix/Valeur | N/A |

| Valeur / Action | N/A |

| Cash / Action | N/A |

| FCF yield | N/A |

| Volume | 627.000 / 600.000 |

|---|---|

| Vol. relatif | 1.05 × |

| BPA | N/A |

|---|---|

| BPA Q/Q | N/A |

| BPA estimée Q/Q | N/A |

| Marge bénéficiaire | N/A |

|---|---|

| Marge oper. | N/A |

| Marge brute | N/A |

| EBIT margin | N/A |

| EBITDA margin | N/A |

| Ret. sur les actifs | N/A |

|---|---|

| Ret. sur l'équité | N/A |

| ROIC | N/A |

| ROCE | N/A |

| Dette/Equité | N/A |

|---|---|

| Net debt/EBITDA | N/A |

| Current ratio | N/A |

| Quick ratio | N/A |

| Volatilité | 22577.81% |

|---|---|

| Beta | N/A |

| RSI | 20.59 |

|---|

| Actions en circ. | N/A |

|---|---|

| Float d'actions | N/A |

| Court % de float | N/A |

| Ratio court | N/A |

| Dividende | N/A |

|---|---|

| Rendement en dividendes | N/A |

| Le ratio de distribution | N/A |

| Date de paiement | N/A |

| Date ex-dividende | N/A |

| Date de gains | N/A |

| Année d'introduction en bourse | 2006 |

|---|---|

| Pays | N/A |

| Revenu | N/A |

|---|---|

| BAIIA | N/A |

| Revenu | N/A |

| Revenu Q/Q | N/A |

| Revenu Y/Y | N/A |

| P/E | N/A |

|---|---|

| Transmettre P/E | N/A |

| EV/Sales | N/A |

| VE/BAIIA | N/A |

| EV/EBIT | N/A |

| PEG | N/A |

| Prix / Ventes | N/A |

| P/FCF | N/A |

| Prix/Valeur | N/A |

| Valeur / Action | N/A |

| Cash / Action | N/A |

| FCF yield | N/A |

| Volume | 6.504k / 24.032k |

|---|---|

| Vol. relatif | 0.27 × |

| BPA | N/A |

|---|---|

| BPA Q/Q | N/A |

| BPA estimée Q/Q | N/A |

| Marge bénéficiaire | N/A |

|---|---|

| Marge oper. | N/A |

| Marge brute | N/A |

| EBIT margin | N/A |

| EBITDA margin | N/A |

| Ret. sur les actifs | N/A |

|---|---|

| Ret. sur l'équité | N/A |

| ROIC | N/A |

| ROCE | N/A |

| Dette/Equité | N/A |

|---|---|

| Net debt/EBITDA | N/A |

| Current ratio | N/A |

| Quick ratio | N/A |

| Volatilité | 78.78% |

|---|---|

| Beta | N/A |

| RSI | 20.75 |

|---|

| Gamme | GBX0.00 – GBX2,408.00 |

|---|---|

| 52 semaines | GBX1,795.50 – GBX74,375.00 |

| SMA 50 | GBX5,758 -139.12% |

| SMA 200 | GBX42,524 -1,665.96% |

| Actions en circ. | N/A |

|---|---|

| Float d'actions | N/A |

| Court % de float | N/A |

| Ratio court | N/A |

| Dividende | N/A |

|---|---|

| Rendement en dividendes | N/A |

| Le ratio de distribution | N/A |

| Date de paiement | N/A |

| Date ex-dividende | N/A |

| Date de gains | N/A |

| Année d'introduction en bourse | 2019 |

|---|---|

| Pays | N/A |

| Capitalisation boursière | $110.28M |

|---|---|

| Valeur d'entreprise | $109.90M |

| Revenu | $0.00 |

|---|---|

| BAIIA | N/A |

| Revenu | -$2.38 |

| Revenu Q/Q | N/A |

| Revenu Y/Y | N/A |

| P/E | 202.50 |

|---|---|

| Transmettre P/E | N/A |

| EV/Sales | N/A |

| VE/BAIIA | N/A |

| EV/EBIT | N/A |

| PEG | N/A |

| Prix / Ventes | N/A |

| P/FCF | N/A |

| Prix/Valeur | 0.00 |

| Valeur / Action | 2,992.50 |

| Cash / Action | 264.56 |

| FCF yield | -1.30% |

| Volume | 37.045k / 20.000 |

|---|---|

| Vol. relatif | 1,852.25 × |

| BPA | 0.04 |

|---|---|

| BPA Q/Q | N/A |

| BPA estimée Q/Q | N/A |

| Marge bénéficiaire | 0.00% |

|---|---|

| Marge oper. | N/A |

| Marge brute | N/A |

| EBIT margin | N/A |

| EBITDA margin | N/A |

| Ret. sur les actifs | -1.29% |

|---|---|

| Ret. sur l'équité | -47.52% |

| ROIC | -0.64% |

| ROCE | -7.79% |

| Dette/Equité | 59.62 |

|---|---|

| Net debt/EBITDA | N/A |

| Current ratio | 0.05 |

| Quick ratio | 0.05 |

| Volatilité | 90581.25% |

|---|---|

| Beta | 0.06 |

| RSI | 13.36 |

|---|

| Gamme | $8.10 – $8.10 |

|---|---|

| 52 semaines | $8.10 – $8.10 |

| SMA 50 | $68,450 -844,961.73% |

| SMA 200 | $66,000 -814,714.81% |

| Propriété du management | 0.00% |

|---|---|

| Proprieté inst. | 100.00% |

| Actions en circ. | 6.123M |

|---|---|

| Float d'actions | 3.394M 55.43% |

| Court % de float | 0.63% |

| Ratio court | 3.42 |

| Dividende | N/A |

|---|---|

| Rendement en dividendes | N/A |

| Le ratio de distribution | N/A |

| Date de paiement | N/A |

| Date ex-dividende | N/A |

| Date de gains | N/A |

| Année d'introduction en bourse | 2017 |

|---|---|

| Pays | United States |

| Capitalisation boursière | $3.18M |

|---|---|

| Valeur d'entreprise | $6.03M |

| Revenu | AUD$984.000k |

|---|---|

| BAIIA | AUD$2.831M |

| Revenu | AUD$7.124M |

| Revenu Q/Q | -53.53% |

| Revenu Y/Y | N/A |

| P/E | N/A |

|---|---|

| Transmettre P/E | N/A |

| EV/Sales | 8.83 |

| VE/BAIIA | 3.07 |

| EV/EBIT | N/A |

| PEG | N/A |

| Prix / Ventes | 0.19 |

| P/FCF | N/A |

| Prix/Valeur | -2.00 |

| Valeur / Action | -2.21 |

| Cash / Action | 0.02 |

| FCF yield | N/A |

| Volume | 129.650k / 0.000 |

|---|---|

| Vol. relatif | N/A |

| BPA | -0.40 |

|---|---|

| BPA Q/Q | N/A |

| BPA estimée Q/Q | N/A |

| Marge bénéficiaire | -236.51% |

|---|---|

| Marge oper. | 287.91% |

| Marge brute | 46.23% |

| EBIT margin | N/A |

| EBITDA margin | 287.70% |

| Ret. sur les actifs | 340.51% |

|---|---|

| Ret. sur l'équité | -249.89% |

| ROIC | N/A |

| ROCE | 0.00% |

| Dette/Equité | -2.26 |

|---|---|

| Net debt/EBITDA | N/A |

| Current ratio | 0.65 |

| Quick ratio | 0.04 |

| Volatilité | 6554.72% |

|---|---|

| Beta | 0.17 |

| RSI | 0.03 |

|---|

| Gamme | AUD$0.07 – AUD$0.07 |

|---|---|

| 52 semaines | AUD$0.07 – AUD$0.07 |

| SMA 50 | AUD$4 -6,400.00% |

| SMA 200 | AUD$4 -6,400.00% |

| Propriété du management | 65.98% |

|---|---|

| Proprieté inst. | 0.91% |

| Actions en circ. | 67.409M |

|---|---|

| Float d'actions | 45.636M 67.70% |

| Court % de float | N/A |

| Ratio court | N/A |

| Dividende | N/A |

|---|---|

| Rendement en dividendes | N/A |

| Le ratio de distribution | N/A |

| Date de paiement | N/A |

| Date ex-dividende | N/A |

| Date de gains | N/A |

| Année d'introduction en bourse | 2016 |

|---|---|

| Pays | Australia |

GRPLTD

| Capitalisation boursière | $32.48M |

|---|---|

| Valeur d'entreprise | $40.67M |

| Revenu | ₨4.458B |

|---|---|

| BAIIA | ₨173.723M |

| Revenu | ₨103.520M |

| Revenu Q/Q | 16.22% |

| Revenu Y/Y | 24.97% |

| P/E | 30.44 |

|---|---|

| Transmettre P/E | N/A |

| EV/Sales | 0.73 |

| VE/BAIIA | 18.68 |

| EV/EBIT | 53.73 |

| PEG | N/A |

| Prix / Ventes | 0.58 |

| P/FCF | N/A |

| Prix/Valeur | 1.82 |

| Valeur / Action | 1,874.87 |

| Cash / Action | 212.49 |

| FCF yield | N/A |

| Volume | 1.714k / 4.873k |

|---|---|

| Vol. relatif | 0.35 × |

| BPA | 112.05 |

|---|---|

| BPA Q/Q | N/A |

| BPA estimée Q/Q | N/A |

| Marge bénéficiaire | 1.48% |

|---|---|

| Marge oper. | 1.36% |

| Marge brute | 51.93% |

| EBIT margin | 1.36% |

| EBITDA margin | 3.90% |

| Ret. sur les actifs | 1.36% |

|---|---|

| Ret. sur l'équité | 7.60% |

| ROIC | 1.17% |

| ROCE | 3.36% |

| Dette/Equité | 1.17 |

|---|---|

| Net debt/EBITDA | N/A |

| Current ratio | 1.65 |

| Quick ratio | 1.20 |

| Volatilité | 16.15% |

|---|---|

| Beta | 0.47 |

| RSI | 22.01 |

|---|

| Gamme | ₨3,400.00 – ₨3,550.00 |

|---|---|

| 52 semaines | ₨3,300.00 – ₨16,744.00 |

| SMA 50 | ₨8,787 -157.67% |

| SMA 200 | ₨8,502 -149.31% |

| Propriété du management | 66.96% |

|---|---|

| Proprieté inst. | 0.00% |

| Actions en circ. | 1.333M |

|---|---|

| Float d'actions | 497.187k 37.29% |

| Court % de float | N/A |

| Ratio court | N/A |

| Dividende | ₨37.50 |

|---|---|

| Rendement en dividendes | 1.07% |

| Le ratio de distribution | 33.47% |

| Date de paiement | N/A |

| Date ex-dividende | N/A |

| Date de gains | N/A |

| Année d'introduction en bourse | 2015 |

|---|---|

| Pays | India |

| Capitalisation boursière | $4.51B |

|---|---|

| Valeur d'entreprise | $4.28B |

| Revenu | ₨31.692B |

|---|---|

| BAIIA | ₨5.730B |

| Revenu | ₨4.742B |

| Revenu Q/Q | -14.10% |

| Revenu Y/Y | 88.28% |

| P/E | 90.42 |

|---|---|

| Transmettre P/E | N/A |

| EV/Sales | 10.78 |

| VE/BAIIA | 59.61 |

| EV/EBIT | 45.50 |

| PEG | N/A |

| Prix / Ventes | 11.89 |

| P/FCF | N/A |

| Prix/Valeur | 20.84 |

| Valeur / Action | 2,454.08 |

| Cash / Action | 1,705.19 |

| FCF yield | N/A |

| Volume | 124.000 / 206.000 |

|---|---|

| Vol. relatif | 0.60 × |

| BPA | 565.70 |

|---|---|

| BPA Q/Q | N/A |

| BPA estimée Q/Q | N/A |

| Marge bénéficiaire | 14.94% |

|---|---|

| Marge oper. | 17.42% |

| Marge brute | 49.69% |

| EBIT margin | 17.42% |

| EBITDA margin | 18.08% |

| Ret. sur les actifs | 11.74% |

|---|---|

| Ret. sur l'équité | 23.10% |

| ROIC | 13.44% |

| ROCE | N/A |

| Dette/Equité | 0.59 |

|---|---|

| Net debt/EBITDA | N/A |

| Current ratio | 2.53 |

| Quick ratio | 2.43 |

| Volatilité | 2.97% |

|---|---|

| Beta | 0.31 |

| RSI | 38.81 |

|---|

| Gamme | ₨50,850.00 – ₨51,448.00 |

|---|---|

| 52 semaines | ₨34,990.00 – ₨59,700.00 |

| SMA 50 | ₨52,983 -3.76% |

| SMA 200 | ₨48,060 +5.88% |

| Propriété du management | 75.17% |

|---|---|

| Proprieté inst. | 13.87% |

| Actions en circ. | 8.842M |

|---|---|

| Float d'actions | 2.161M 24.44% |

| Court % de float | N/A |

| Ratio court | N/A |

| Dividende | ₨100.00 |

|---|---|

| Rendement en dividendes | 0.19% |

| Le ratio de distribution | 17.68% |

| Date de paiement | N/A |

| Date ex-dividende | N/A |

| Date de gains | N/A |

| Année d'introduction en bourse | 2000 |

|---|---|

| Pays | India |

KSB

| Capitalisation boursière | $826.81M |

|---|---|

| Valeur d'entreprise | $791.14M |

| Revenu | ₨17.420B |

|---|---|

| BAIIA | ₨2.208B |

| Revenu | ₨1.662B |

| Revenu Q/Q | 17.17% |

| Revenu Y/Y | 22.45% |

| P/E | 18.87 |

|---|---|

| Transmettre P/E | 33.90 |

| EV/Sales | 3.62 |

| VE/BAIIA | 28.60 |

| EV/EBIT | 34.91 |

| PEG | N/A |

| Prix / Ventes | 3.79 |

| P/FCF | N/A |

| Prix/Valeur | 2.62 |

| Valeur / Action | 340.05 |

| Cash / Action | 80.77 |

| FCF yield | N/A |

| Volume | 42.378k / 108.933k |

|---|---|

| Vol. relatif | 0.39 × |

| BPA | 47.18 |

|---|---|

| BPA Q/Q | N/A |

| BPA estimée Q/Q | N/A |

| Marge bénéficiaire | 9.98% |

|---|---|

| Marge oper. | 10.38% |

| Marge brute | 45.98% |

| EBIT margin | 10.38% |

| EBITDA margin | 12.67% |

| Ret. sur les actifs | 6.97% |

|---|---|

| Ret. sur l'équité | 16.08% |

| ROIC | 7.78% |

| ROCE | N/A |

| Dette/Equité | 0.59 |

|---|---|

| Net debt/EBITDA | N/A |

| Current ratio | 2.13 |

| Quick ratio | 1.14 |

| Volatilité | 16.53% |

|---|---|

| Beta | 0.59 |

| RSI | 14.10 |

|---|

| Gamme | ₨882.50 – ₨900.00 |

|---|---|

| 52 semaines | ₨883.00 – ₨5,300.00 |

| SMA 50 | ₨1,348 -51.05% |

| SMA 200 | ₨3,875 -334.15% |

| Propriété du management | 69.92% |

|---|---|

| Proprieté inst. | 12.22% |

| Actions en circ. | 34.808M |

|---|---|

| Float d'actions | 10.464M 30.06% |

| Court % de float | N/A |

| Ratio court | N/A |

| Dividende | ₨17.50 |

|---|---|

| Rendement en dividendes | 1.91% |

| Le ratio de distribution | 37.09% |

| Date de paiement | N/A |

| Date ex-dividende | N/A |

| Date de gains | N/A |

| Année d'introduction en bourse | 2012 |

|---|---|

| Pays | India |

KAYCEEI

| Capitalisation boursière | $6.28M |

|---|---|

| Valeur d'entreprise | $5.92M |

| Revenu | ₨203.689M |

|---|---|

| BAIIA | ₨16.350M |

| Revenu | ₨8.438M |

| Revenu Q/Q | -53.02% |

| Revenu Y/Y | N/A |

| P/E | 25.75 |

|---|---|

| Transmettre P/E | N/A |

| EV/Sales | 2.32 |

| VE/BAIIA | 28.88 |

| EV/EBIT | 11.26 |

| PEG | N/A |

| Prix / Ventes | 1.29 |

| P/FCF | N/A |

| Prix/Valeur | 1.47 |

| Valeur / Action | 2,235.67 |

| Cash / Action | 453.72 |

| FCF yield | N/A |

| Volume | 12.698k / 3.809k |

|---|---|

| Vol. relatif | 3.33 × |

| BPA | 127.92 |

|---|---|

| BPA Q/Q | N/A |

| BPA estimée Q/Q | N/A |

| Marge bénéficiaire | 6.05% |

|---|---|

| Marge oper. | 6.67% |

| Marge brute | 52.90% |

| EBIT margin | 6.67% |

| EBITDA margin | 8.03% |

| Ret. sur les actifs | 6.63% |

|---|---|

| Ret. sur l'équité | 6.04% |

| ROIC | 7.67% |

| ROCE | N/A |

| Dette/Equité | 0.41 |

|---|---|

| Net debt/EBITDA | N/A |

| Current ratio | 3.09 |

| Quick ratio | 2.44 |

| Volatilité | 6.87% |

|---|---|

| Beta | 0.22 |

| RSI | 44.91 |

|---|

| Gamme | ₨3,294.00 – ₨3,296.05 |

|---|---|

| 52 semaines | ₨1,188.79 – ₨58,273.85 |

| SMA 50 | ₨2,171 +34.13% |

| SMA 200 | ₨18,808 -470.61% |

| Propriété du management | 74.91% |

|---|---|

| Proprieté inst. | 0.00% |

| Actions en circ. | 63.470k |

|---|---|

| Float d'actions | 12.466k 19.64% |

| Court % de float | N/A |

| Ratio court | N/A |

| Dividende | ₨0.80 |

|---|---|

| Rendement en dividendes | 0.03% |

| Le ratio de distribution | 0.63% |

| Date de paiement | N/A |

| Date ex-dividende | N/A |

| Date de gains | N/A |

| Année d'introduction en bourse | 2000 |

|---|---|

| Pays | India |

| Capitalisation boursière | $4.60B |

|---|---|

| Valeur d'entreprise | $4.26B |

| Revenu | ₨31.084B |

|---|---|

| BAIIA | ₨4.194B |

| Revenu | ₨3.822B |

| Revenu Q/Q | 7.74% |

| Revenu Y/Y | 4.76% |

| P/E | 135.86 |

|---|---|

| Transmettre P/E | 80.58 |

| EV/Sales | 10.94 |

| VE/BAIIA | 81.09 |

| EV/EBIT | 83.51 |

| PEG | N/A |

| Prix / Ventes | 11.80 |

| P/FCF | N/A |

| Prix/Valeur | 15.53 |

| Valeur / Action | 3,296.00 |

| Cash / Action | 2,330.37 |

| FCF yield | N/A |

| Volume | 2.080k / 7.741k |

|---|---|

| Vol. relatif | 0.27 × |

| BPA | 376.67 |

|---|---|

| BPA Q/Q | N/A |

| BPA estimée Q/Q | N/A |

| Marge bénéficiaire | 11.50% |

|---|---|

| Marge oper. | 13.10% |

| Marge brute | 47.15% |

| EBIT margin | 13.10% |

| EBITDA margin | 13.49% |

| Ret. sur les actifs | 6.20% |

|---|---|

| Ret. sur l'équité | 13.50% |

| ROIC | 7.10% |

| ROCE | 13.46% |

| Dette/Equité | 0.41 |

|---|---|

| Net debt/EBITDA | N/A |

| Current ratio | 3.38 |

| Quick ratio | 3.26 |

| Volatilité | 2.59% |

|---|---|

| Beta | 0.31 |

| RSI | 42.56 |

|---|

| Gamme | ₨50,652.35 – ₨51,498.00 |

|---|---|

| 52 semaines | ₨34,977.70 – ₨59,994.00 |

| SMA 50 | ₨52,493 -2.14% |

| SMA 200 | ₨48,284 +6.05% |

| Propriété du management | 78.98% |

|---|---|

| Proprieté inst. | 9.61% |

| Actions en circ. | 8.842M |

|---|---|

| Float d'actions | 2.196M 24.84% |

| Court % de float | N/A |

| Ratio court | N/A |

| Dividende | ₨100.00 |

|---|---|

| Rendement en dividendes | 0.20% |

| Le ratio de distribution | 26.55% |

| Date de paiement | N/A |

| Date ex-dividende | N/A |

| Date de gains | N/A |

| Année d'introduction en bourse | 2002 |

|---|---|

| Pays | India |